Excess is included in a private motor insurance to deter motorists from making small claims. Excess is the initial amount of any claim that the auto insurer will not pay. In other words, the car owner has to bear this cost.

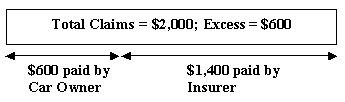

For example, if the cost of your claims amount to $2,000 and the deductible is $600, you’ll have to bear $600 while the rest can be claimed from the insurer. An illustration is drawn for you below:

If the total amount (for repairs, damages, etc) is less than the excess ($600), nothing is payable by the insurer.

But…why do the insurers want to impose such an idea on motor car insurance? Because…

– The insurers hopes that the drivers will take more care and responsibility as the driver still has to pay for damages not exceeding the excess amount.

– Claim payouts (by the insurers) are reduced by the excess amount, the risk/liability of the insurer is also reduced. This also lowers the insurance premiums.

– There are fixed costs incurred to service each claim, it doesn’t make sense (economically) for the insurers to attend to each and every small claim.

– For customers with bad claims experience (profiled as high risk for the insurers), higher excess can be imposed to allow their car insurance to remain in force. This also keeps their premiums within financial reach.

You can certainly request for excess to be removed or reduced in some cases. But since the insurers are taking on extra risk, your premiums will go up by quite an amount. For drivers under 21 (or 23) years old, such excess cannot be removed.